Amid the labyrinth of fiscal obligations and financial documents, IRS Form 1098-T emerges as an essential beacon for students navigating the complexities of educational expenses and potential tax credits. This widespread student tax form 1098-T, formally known as the Tuition Statement, serves a critical role for both students and educational institutions; it's a document that details the amounts paid for education, related expenses, and scholarships received during the fiscal year. The information on Form 1098-T can unlock opportunities for tax deductions or credits, making it a pivotal piece of the puzzle for those seeking to alleviate the financial burdens of higher education.

In pursuing fiscal clarity and academic advancement, our website, 1098t-form.net, proves to be an invaluable resource. With the printable 1098-T form for 2023, students and their families can access and prepare their tax documents in the comfort of their homes. The platform goes beyond mere template provision; it offers comprehensive IRS Form 1098-T instructions supplemented with illustrative examples. By leveraging the resources available on our website, individuals can confidently fill out their forms, ensuring they are well-prepared to claim every educational benefit they are entitled to under the law.

Primary 1098-T Tax Form Instructions & Exemptions

Navigating the complexities of tax forms can often seem like a daunting task, especially when it comes to educational expenses. Those who must confront this challenge are the individuals or entities that disburse qualifying tuition and related expenses on behalf of students. If you are in this category, a critical document at your disposal is the 1098-T tuition statement. It is a significant puzzle piece when calculating potential education credits during tax time.

Eligibility for the tuition statement 1098-T is not universal, and specific circumstances exempt certain parties from this filing requirement. Those fortunate to bypass this obligation include:

- Students whose tuition is entirely covered by scholarships or grants.

- Students who are enrolled in courses that do not award academic credit from institutions committed to providing such credentials.

- Individuals attending foreign universities or schools where the IRS does not mandate reporting.

Completing and providing this form can be done conveniently and accurately using modern tools. To effortlessly obtain a blank sample of the 1098-T form for 2023, our online resources are available at your fingertips. Furthermore, with just a few clicks, you can get 1098-T online through a user-friendly platform to streamline the task. Our website offers the necessary templates and the capability to fill them out directly through our secure portal. This ensures that compliance with IRS requirements is simple and error-free, allowing individuals to focus more on their educational aspirations and less on their tax obligations.

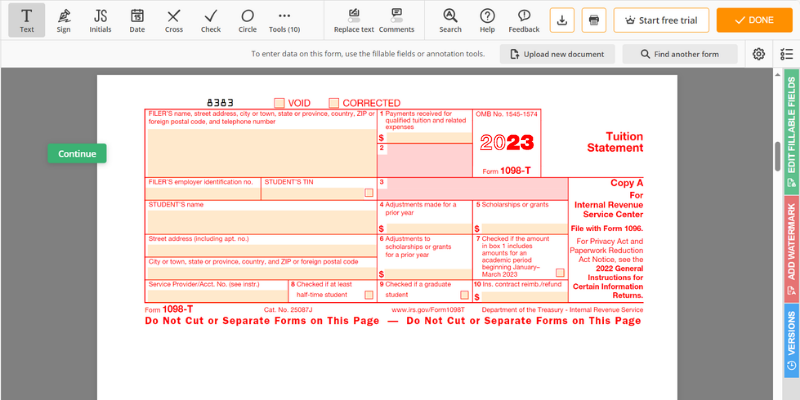

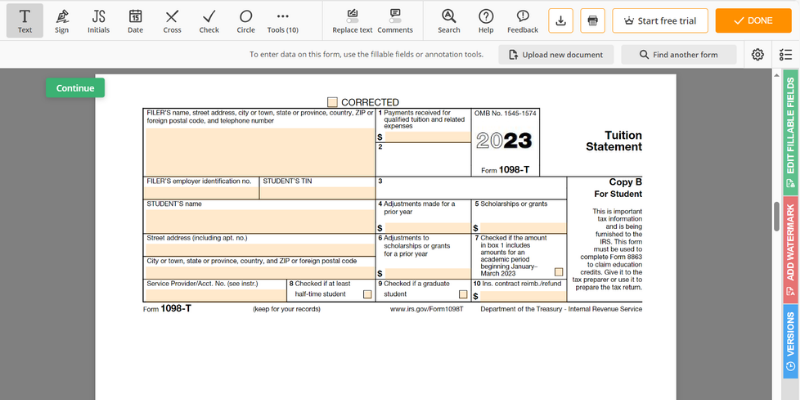

Steps to Fill Out the Blank 1098-T Form for Tax Year 2023

Embarking on navigating educational expenses at tax time can be a labyrinth for many, but armed with proper guidance and resources, the trek through IRS Form 1098-T need not be arduous. Here's a step-by-step guide to ensure you fill out the form flawlessly:

- Visit our trusted website and download the 1098-T blank form, ensuring you're working with the most up-to-date version for the 2023 tax year.

- Carefully review the form’s instructions to familiarize yourself with the required information, including the educational institution's details and the expenses paid.

- Collect all necessary documents, such as tuition payment receipts and scholarship information, before completing the form.

- Use the 1098-T tax form example provided on the website to understand how to correctly input your personal information and figures in the relevant sections.

- Enter your educational institution's information, including its federal identification number, accurately to avoid any processing hiccups.

- Input your financial details, such as amounts paid for qualified tuition and related expenses; double-check these with your payment records.

- If applicable, report scholarships or grants received in the appropriate box; these figures can affect the amount of credit you claim.

- Review your 1098-T form for 2023 in PDF thoroughly for potential errors, as accuracy is paramount to ensure you receive the correct educational tax credits or deductions.

Remember, the time you invest in ensuring each detail is meticulously reported can spare you from the maze of amendments later on. When in doubt, consult with a tax professional to illuminate the path to a precise and compliant submission.

File Form 1098-T Before the Deadline

Navigating the intricate tapestry of taxation, one cannot overlook the importance of adhering to deadlines, especially educational expenses. Institutions must lodge the tax form 1098-T: Tuition Statement, which details the amounts paid for classes and related fees, by January 31st. This critical document is a cornerstone for students or their families to claim education credits.

Should this pivotal deadline be missed, the ramifications are severe, including penalties that can escalate with time. Missteps such as filing late or, worse, submitting a falsified 1098-T statement undermine the integrity of the tax system and can lead to substantial fines. These punitive measures are a stark reminder of the gravity the Internal Revenue Service places on the accuracy and timeliness of our tax-related endeavors.

College Tax Form 1098-T

College Tax Form 1098-T

1098-T Student Form

1098-T Student Form

1098-T Form Instructions

1098-T Form Instructions

Printable Tax Form 1098-T

Printable Tax Form 1098-T

1098-T Tuition Tax Form

1098-T Tuition Tax Form